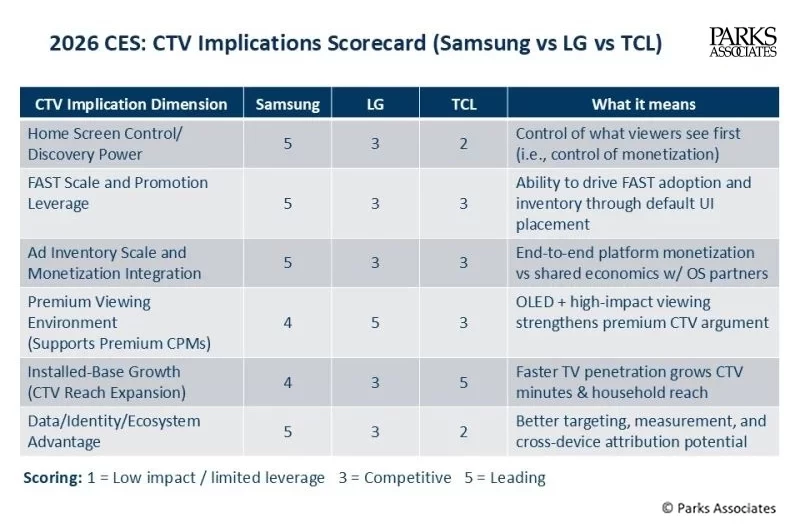

Platform control and integrated monetization matter most for CTV power, even as premium hardware and scale shape different parts of the opportunity. Samsung is the overall CTV leader, driven by its advantage in home screen/discovery control, FAST promotion, ad monetization integration, and data/ecosystem leverage. LG leads on premium viewing environment, reinforcing premium CTV value and CPM potential, while TCL leads on installed-base growth, helping expand CTV reach and viewing minutes. This is important because it shows where CTV power and money are concentrating in 2026, and it’s increasingly not just in content, but in the TV platform layer.

- Control of the home screen controls discovery. This directly drives viewing, subscriptions, FAST engagement, and ad inventory. That’s why Samsung scoring highest there matters as it can influence what people watch first and monetize that position.

- FAST is becoming the new mass-market TV bundle. Brands that can promote FAST at the OS level will capture more ad-supported viewing time and ad dollars.

- Premium viewing quality (LG) supports higher-value advertising. Brands pay more for big-screen, high-impact environments, helping justify premium CPMs and sponsorship-style deals.

- Installed-base growth (TCL) expands total CTV reach. This grows the overall market size, but if TCL relies on partner OS layers, it doesn’t capture as much of the platform monetization upside.

This scorecard helps predict who wins the next phase of CTV economics. The companies that own distribution, discovery, and monetization infrastructure will capture disproportionate value.