Over the past decade, a growing percentage of US are connected to the internet, but do not receive home internet service from a traditional home internet provider. The bulk of these consumers are “mobile-only”, connected via a smartphone or tablet. With the launch of 5G home internet, and new low-orbit satellite networks, the market is poised for further shifts.

Fiber, fixed wireless buildouts set the stage for a Gigabit world. Accelerated by the pandemic, consumer demand for high-bandwidth, low latency service is only growing. A majority of consumers report that they are “likely” to upgrade to Gigabit speeds once available in their area, and with fiber network buildouts and edgeouts – as well as upgrades to existing hybrid fiber-coaxial networks – an ever larger number of subscribers are falling into that category. At the same time, wireless providers are turning to fixed wireless solutions – including cellular backhaul – to offer services to residential subscribers and business customers in urban and suburban markets.

In 2021, T-Mobile hit ~650K high-speed internet subscribers, including both 5G and LTE fixed wireless to the home. It was the fastest growing US ISP in the 4th quarter. For 2021, it was third behind Comcast and Spectrum.

Satellite providers are beginning to be impacted by cable edge-outs and new fiber builds that are connecting unconnected and underserved households. Fixed wireless has not yet had a material impact on rural connectivity.

Mobile-only households – that is, households with a mobile internet subscription via a mobile endpoint device – have been in decline since the beginning of the pandemic. Cost and preference for mobile service are top drivers of broadband cord-cutting.

Demand for more bandwidth and higher quality service remain key accelerators across the broadband industry. 5G rollouts have helped drive adoption of fixed wireless home internet in urban and suburban areas, but have not resulted in increases to mobile-only subscriptions.

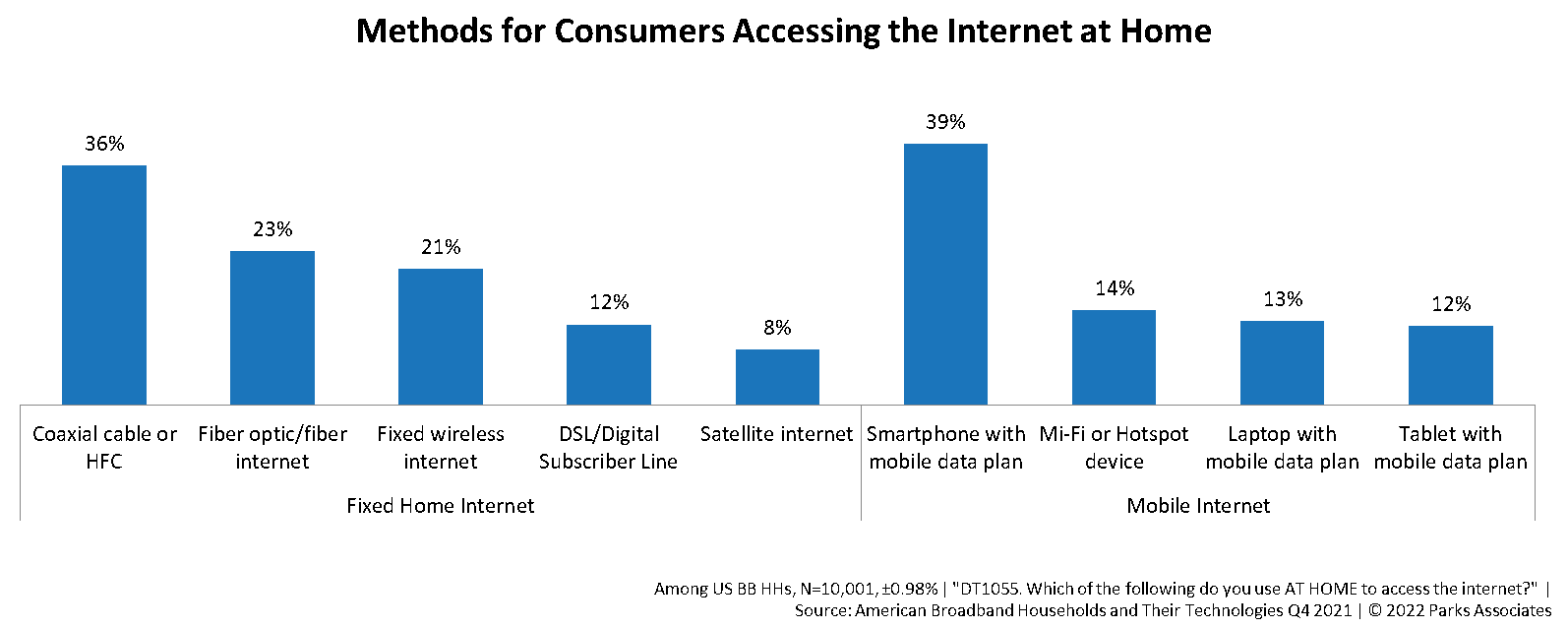

Our recent data of 10,000 internet households shows that consumers access the internet at home through a variety of methods. Cable, hybrid-fiber cable, and fiber-to-the-home are the top home internet access methods. Note that adoption of fixed wireless is highly over-reported among US consumers, with many consumers confusing it with 5G or use of hotspots. Parks Associates estimates that consumer fixed wireless subscriptions accounted for ~7-8% of total fixed home internet subscriptions as of the end of December 2021.

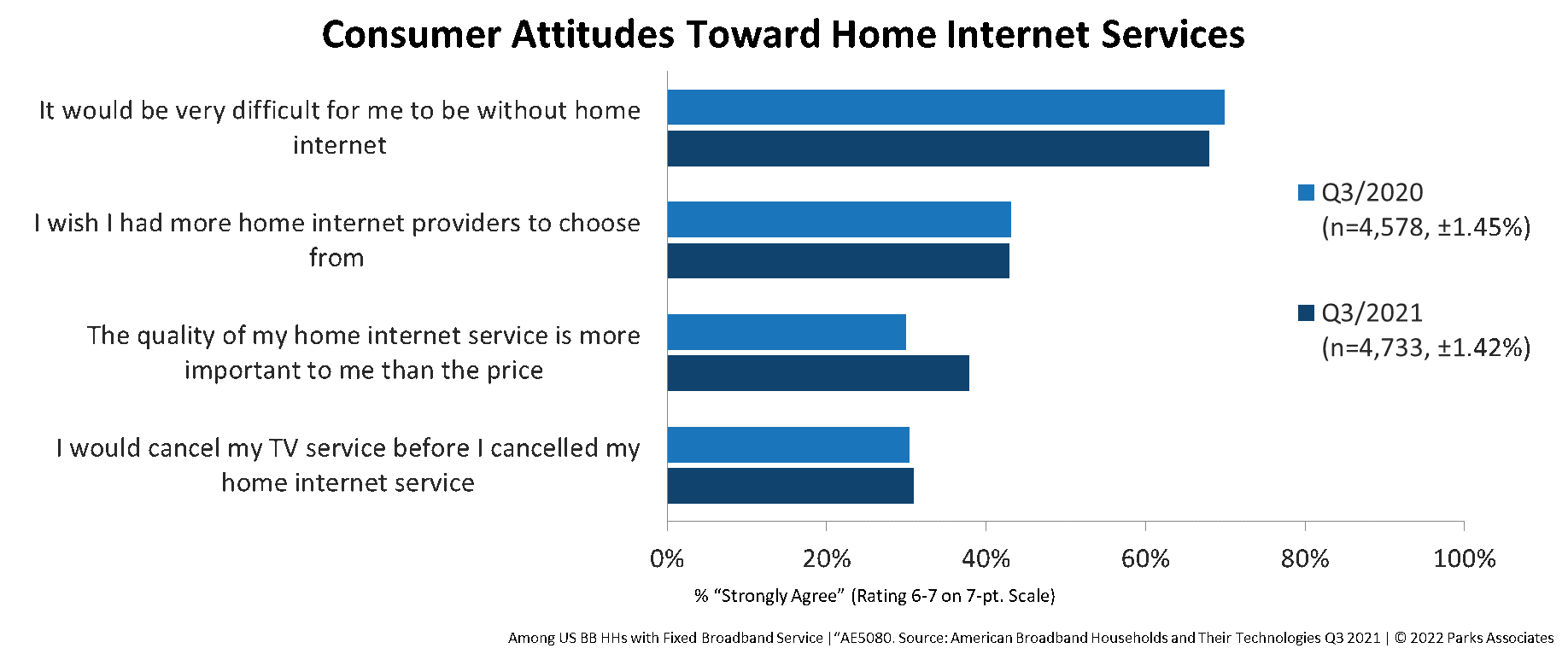

One particular point from our new research study, Fixed vs. Wireless – Consumers’ Shifting Broadband Preferences, shows consumers overall are increasingly concerned with quality over price. An increasing percentage of consumers report that the quality of their home internet service is more important than its price. This shift comes as consumers increasingly begin upgrading to Gigabit speeds.

Remote work, remote schooling, and increased use of OTT video and gaming services have increased traffic on residential broadband and driven upgrades. ISPs have responded by further improving their networks, intensifying their fiber deployments, and upgrading their existing infrastructure. Consumer intention to upgrade their home internet service remains at an all-time high.

With fiber buildouts intensifying and upgrades to HFC infrastructure taking place, consumers increasingly have access to ever-faster and more reliable services. ISPs must elevate their value proposition or risk losing their customers to competitors. This is true even for companies at the lower end of the pricing spectrum.

Parks Associates new study, Fixed vs. Wireless – Consumers’ Shifting Broadband Preferences, was published this week. Authored by Parks Associates REsearch Director Kristen Hanich, the study examines consumer demand for internet connectivity, including demand for new network types and the rationales for fixed broadband cord-cutting.

Key questions addressed:

1) With many remote workers returning to the office, how has consumer demand for connectivity and solutions changed?

2) With mobile-only household growth resume, once the pandemic and resulting pressures have ended?

3) What are the attributes of home internet cord-cutters and cord-nevers, and how can ISPs attract and retain them?

4) What new opportunities have emerged with regards to offering solutions to consumers and their employers?

5) How has demand for Gigabit internet changed?

We welcome all feedback on our research. Please share any comments.