Consumer technical support needs are strongly influenced by the number and type of connected devices consumers have in their homes. More consumers working and attending school from home has led to an increase in the number of computing devices being used in broadband households. As consumers adapt to doing more activities virtually, they encounter more technical problems. At the same time, device manufacturers are adjusting technical support strategies to support customers virtually.

• In 2020, stay-at-home restrictions led Verizon to trial an interactive video tool that allows their technicians to guide customers through the diagnosis and repair of home network issues remotely.

• Cox similarly introduced interactive video to support their customers. The solution leverages video from a smartphone or tablet and uses augmented reality to guide customers through the actions they need to take to set up new equipment or troubleshoot issues.

• Along with service providers leveraging new video support technologies, a number of companies are promoting Wi-Fi optimization services to help consumers manage their home networks better and have better Wi-Fi experiences.

New work at home and school from home activities make home network dependability more critical than in the past and is driving a high willingness to pay for support services that facilitate this. Support providers have new opportunities to support consumers’ new virtual lifestyles. They also have the opportunity to partner with small businesses that are invested in services that promote business continuity as employees work from home.

Check out some of the key trends noted from Parks Associates recent Quantified Consumer study, The Connected Consumer and Changing Support Needs. This consumer research study of 5,000 internet households highlights consumer adoption of traditional and emerging connected devices. It identifies the leading issues consumers experience with these devices and their preferred methods for problem resolution. In addition, the research examines consumer satisfaction with self and professional support solutions and assesses consumer appetite for premium technical support and extended warranty services.

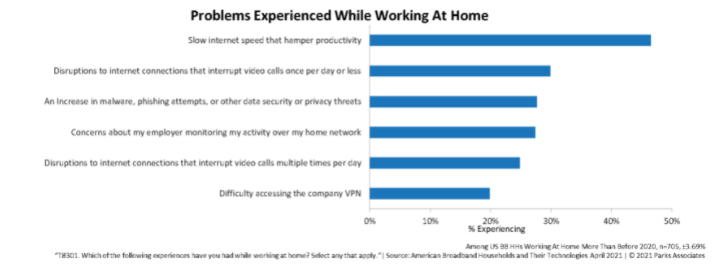

More consumers are working from home remotely and report that slow internet hampers productivity.

28% of US broadband households report working from home more than prior to the pandemic and almost half spending more time working from home report slow internet speeds hamper productivity. Remote work from home will continue and there is significant premium technical support opportunity to promote business continuity and maintain employee productivity.

Consumers are experiencing a growing number of technical problems.

38% of consumers experienced 2+ technical problems with smart home devices over the past year. The increasing number and diversity of devices in the home partially explains more technical problems. The pandemic forced many households to expand their home networks to include more attached devices in order to accommodate working and schooling from home. Consumers have different channel preferences for resolving technical problems and some brands need a variety of support resources. Brands must also take advantage of the growing popularity of support apps that can provide better support experiences and improve over time using data analytics.

The percentage of consumers returning most smart home devices and some CE devices increased over the past two year.

About 2-4% of broadband households returned a smart home device over the past 12 months. Buyers return devices for a variety of reasons—broken/defective products, difficulty installing the device, and the device not working as advertised are the top reasons. The rate of return for individual smart home devices among broadband households is fairly high, especially when you consider such a small percent purchased these devices.

Smart home devices are rarely purchased spontaneously.

Over half of consumers report conducting research prior to making a purchase. Product features and functionality are the types of information most researched prior to device purchase. 37% of consumers rely primarily on manufacturers’ websites for information on devices they plan to purchase and less than half primarily on social sources such as online reviews and social media.

Smart home devices are increasingly DIY setup.

36% of consumers who set up smart home devices on their own experience difficulty. As smart home brands attempt to drive product adoption beyond tech enthusiasts and early adopters, it will be important to offer setup support, so the potential for difficulty with device setup is not a deterrent for product adoption. The availability of professional setup services can also help minimize product returns.

The use of extended warranties and subscription support services for smart home and CE devices has also substantially increased over the last 12 months.

Increasing prompts to add on these services during online purchase checkout is likely helping drive these increases. Support services are broadly appealing to consumers — Services that protect devices from security breaches and those that provide problem resolution resources remain the most appealing.