In today’s smart TV market, the platform is the battleground. Due to the content consumption, user experience, feature options, and data-related revenue it enables – the smart TV software platform now is nearly as important as the hardware itself.

The modern smart TV market is less than 10 years old. It is a success story of a once-niche concept that has since become an incredibly successful consumer electronics (CE) product and mainstay of the modern connected home. Early iterations of the streaming, app-capable smart TV concept were challenging products for consumers. They were frequently saddled with proprietary platforms, slow performance, poorly designed interfaces, limitations to only a handful of preinstalled apps, and were quickly made obsolete by a lack of software updates. Many consumers instead preferred to consume a wider variety of streaming video content via a better-performing TV-connected device, such as a streaming media player, game console, or connected Blu-ray Disc player.

Gradually, the smart TV category evolved. Smart TV functionality not only moved further and further into mainstream-priced models, but performance has continued to improve with each generation. More importantly, the practical need for a separate attached device to be able to watch streaming video acceptably has declined. The cumbersome performance and interfaces of smart TVs of old have given way to modern user experiences (UXs) powered by increasingly powerful multi-core processors.

A substantial reason for this evolution of the product category has been the development of well-defined and regularly-maintained smart TV operating systems (or “platforms”), and the use of these platforms to add functionality and value beyond the simple traditional value equation comprised of cost and hardware specifications. The fast obsolescence of older smart TVs due to quickly outdated custom OTT client apps is now a thing of the past. Updates to streaming services’ apps can be deployed independently through the app stores on today’s smart TV platforms.

The primary point of home entertainment consumption has moved from service provider set-top boxes to consumer-owned streaming devices, and smart TVs are consumers’ preferred streaming device, with 54% of broadband households reporting they own one. TV companies are now aware that the smart TV has now become a treasure trove of data – data that can be leveraged to generate an additional long-term revenue stream via advertising and/or audience measurement. This dynamic has made the one-time short-term transactional revenue generation attached to the sale of each smart TV, now only one component of the total potential smart TV revenue model.

TV manufacturers are now aware of the long-term revenue stream potentially generated by their smart TV installed base. Having the control and ability to implement the per-device level of measurement and control needed to stand up a viable smart TV measurement and advertising business, requires ownership of the smart TV platform itself. As such, what it means to be “in the smart TV business” has now expanded substantially from the definition of years past.

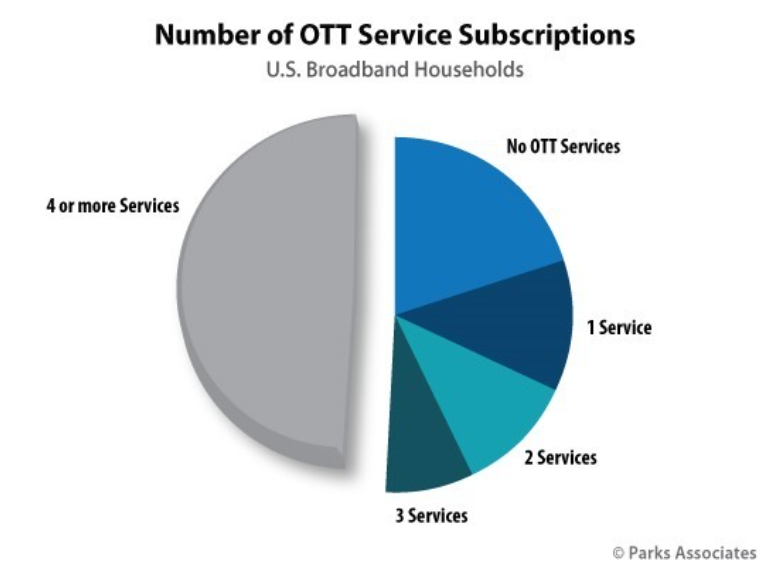

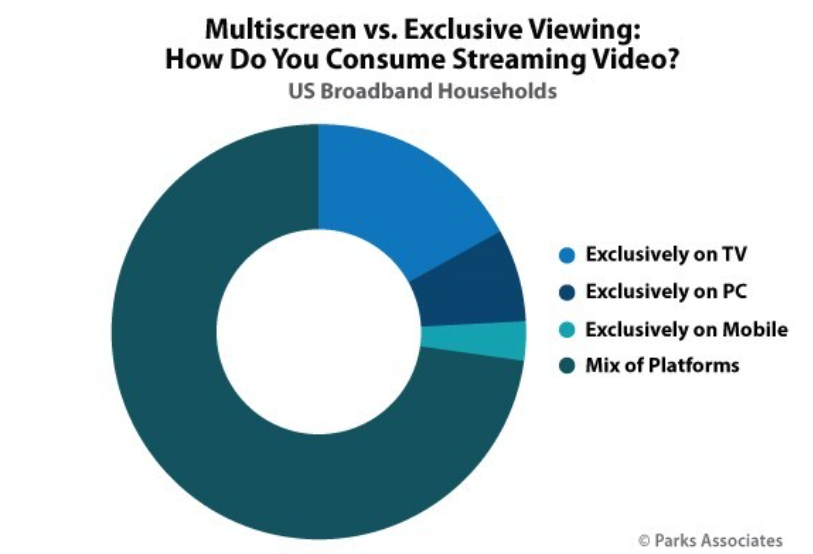

While consumers may subscribe to multiple services in today’s crowded OTT market, when at home they are increasingly consuming all of those services along with broadcast content from a single point of interaction – the smart TV. The disaggregation of content away from traditional pay TV services and bundles, and towards today’s streaming-centric nature of content consumption, has shifted the point of aggregation away from service providers – to the devices themselves. Consumers are rebundling services into their own personal bundles of content, and the device platform ultimately controls how well all of that content can be searched, discovered, and consumed by the viewer.

The ability to control that aggregation, from user experience to personalization to content access to the ability to leverage advertising and measurement data, is in the hands of the platform owners. The most significant beachhead in the home video consumption experience is the smart TV, and the most significant element of the smart TV to control is the platform.

With TVs now the most popular device to watch content on in US broadband households, the players in the smart TV platform market have become the parties that ultimately hold the most power to control the aggregation of the content people watch, the serving of what ads they see, and the measurement of all of their consumption from video to gaming to advertising. Control of the smart TV platform has become crucial to controlling and/or understanding consumers’ relationship with content consumption.

This is an excerpt from Parks Associates recently published industry report Video Streaming Platforms: Rise of the Smart TV. Consumers today have adopted OTT services widely, and are increasingly turning to smart TVs as their primary device at home for consuming video.

Smart TVs now represent the most important point of entertainment aggregation, control, and data collection in the connected home. This report examines the smart TV market today, the evolving role of smart TV operating platforms, related trends, and the US smart TV platform competitive landscape. This report also assesses the market outlook and implications for industry stakeholders, including a 5-year forecast of the smart TV installed base in the United States.