At the 26th annual CONNECTIONS Conference in Frisco Texas hosted by Parks Associates, Dr. John Barrett, Director of Parks Associates Consumer Analytics team gave an informative presentation on consumer segments. The research highlighted consumers’ different familiarity with smart home products and different perceptions of affordability, the value of devices, the appeal of product discounts, and the importance of universal control of smart home devices. Understanding these user segments can help product developers market their products more appropriately to certain segments and understand why some are avid adopters of smart products while others are slow or resistant to adoption.

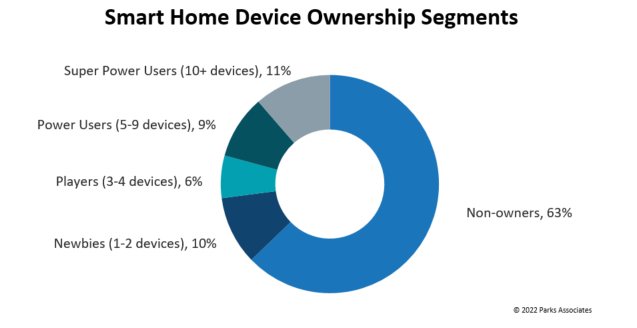

Breaking down user segmentation can be done in various ways. In Dr. Barrett’s presentation, the ways user segments were considered were by the number of smart home devices owned and perception of smart home device affordability and value. In regards to the number of smart devices owned, Parks Associates’ research has identified five clusters of consumers (see Figure 1).

Figure 1. Parks Associates breakdown of identified user segments by the number of smart devices owned.

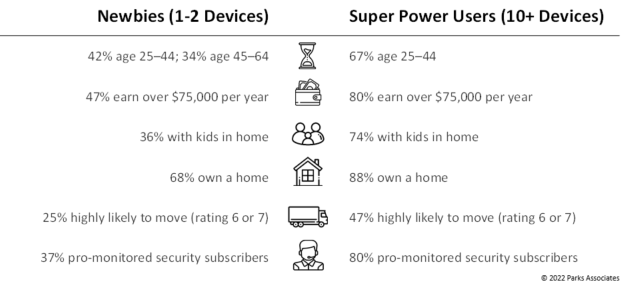

Within the clusters that own smart home devices, some notable demographic trends exist. For example, it was found that the Super Power segment had 33% more participants making greater than $75,000 a year compared to the Newbies segment. Other discerning characteristics between the two segments were the likelihood of having children living at home, homeownership, likelihood to move, and being a pro-monitored security subscriber (see Figure 2).

Figure 2. Parks Associates data comparing the demographics of the Newbies and Super Power Users consumer segments.

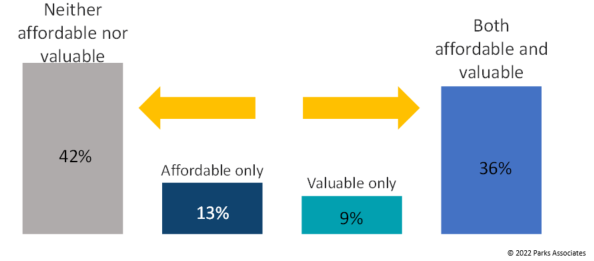

In this presentation, Dr. Barrett also provided insight into how the consumer’s perception of how affordable and valuable smart home devices are (see Figure 3). Out of the four groups identified, the distribution was polarized, with the majority of participants perceiving smart home products as neither affordable nor valuable or affordable and valuable.

![]()

Figure 3. Parks Associates breakdown of identified user segments by their perception of affordability and value of smart devices.

Figure 3. Parks Associates breakdown of identified user segments by their perception of affordability and value of smart devices.

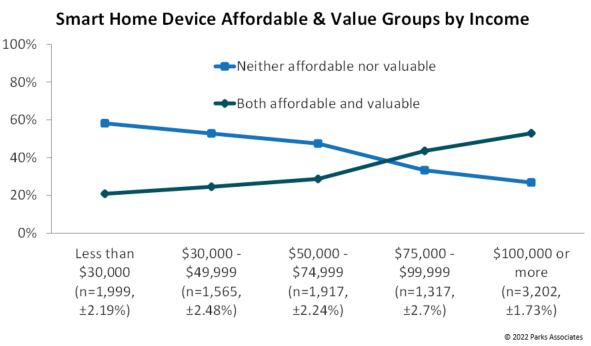

Similar to the breakdown of identified user segments by the number of smart devices owned, the comparison of consumers that perceive smart home products as affordable and valuable saw a demographical difference based on income earning. In consumers that made less than $30,000 a year nearly 40% more consumers saw smart home products as neither affordable nor valuable. This trend was reversed in consumers that make over $100,000 a year, where about 30% more consumers perceived smart home products as affordable and valuable (see Figure 4). ![]()

Figure 4. Parks Associates data on the perception of smart home devices affordability and value based on income earnings.

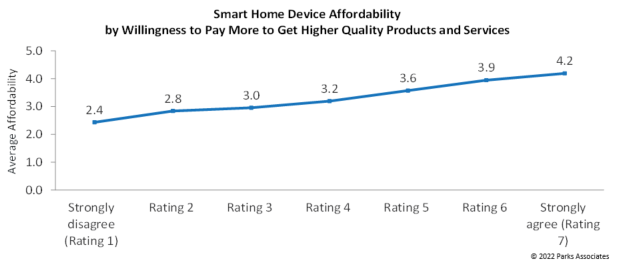

Within the different user segments of perceived affordability in smart home products, Parks Associates’ research found that those who perceived smart home products as more affordable also are more willing to invest more to get higher quality smart home products and services (see figure 5).

![]()

Figure 5. Parks Associates’ data of the relationship between consumers’ perception of affordability of smart home devices and the likelihood to pay more to get a higher quality smart product or service.

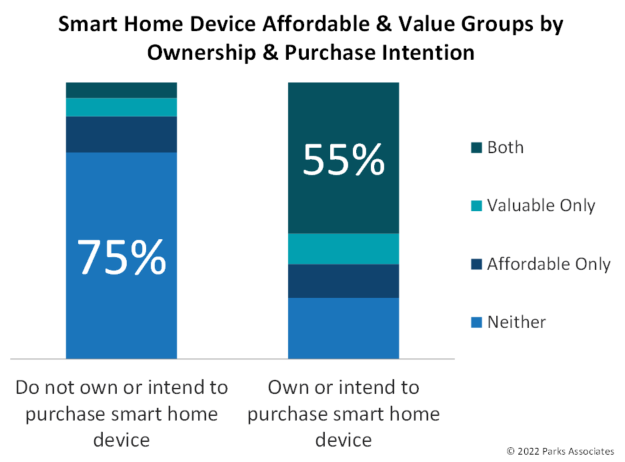

In addition, those who perceived smart home devices as neither affordable nor valuable were much more likely to not own or intend to purchase a smart home device. In contrast, the majority of consumers that perceived smart home products as affordable and valuable were more likely to own or intend to purchase a smart home product (see Figure 6).

Figure 6. Parks Associates data displays the user segments of consumers who perceive smart home products as affordable and valuable and the percentage that owns or intends to purchase a smart home device.

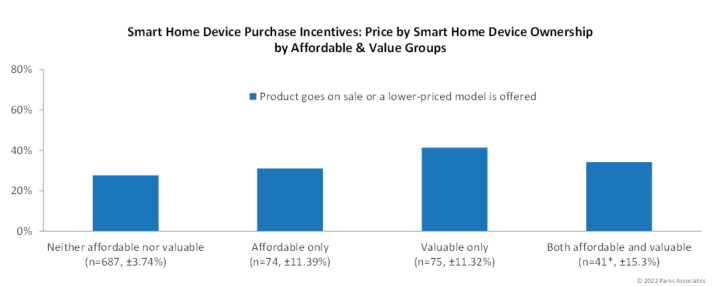

In the presentation, it was also presented how that user segmentation by perceived affordability and value related to how appealing consumers perceived discounts. The user segment perceiving smart devices as just valuable was more likely to perceive discounts on smart home products as more appealing (see Figure 7).

Figure 7. Parks Associates data on the user segments of consumers’ perceptions of smart home products as affordable and valuable and the percentage that perceive discounts on smart home products as appealing.

Parks Associates’ research presentation by Dr. Barrett notes the three most common inhibitors to adopting smart home devices were cost, no perceived benefit, and fear of data security, but consumers, in general, are perceiving smart home products as more affordable but not any more valuable since 2016. It can be inferred that individuals with higher income, that already have smart devices, and that perceive smart devices as affordable and valuable are generally not consumers hard to sell or convince the benefits of smart home products too. In contrast, lower-income earning, non-smart home device owners, and those who perceived smart home products as neither affordable nor valuable are difficult consumer segments to penetrate for smart home product manufacturers.

A deeper understanding of these consumer segments can help smart home product developers understand who they are developing the product for, what they need to do to penetrate other consumer segments, help better predict product sales, and make better use of marketing and advertisement dollars. A statement during the presentation summarized the importance of user segment research best: “We think consumers need to be aware of the products and understand what they do, but more importantly they need to be able to afford them and see the value of the benefits the products offer.