If you are going to ISC West and have new products to highlight, please be sure to share with Parks Associates team. We love to keep up with the latest developments in security and professional monitoring.

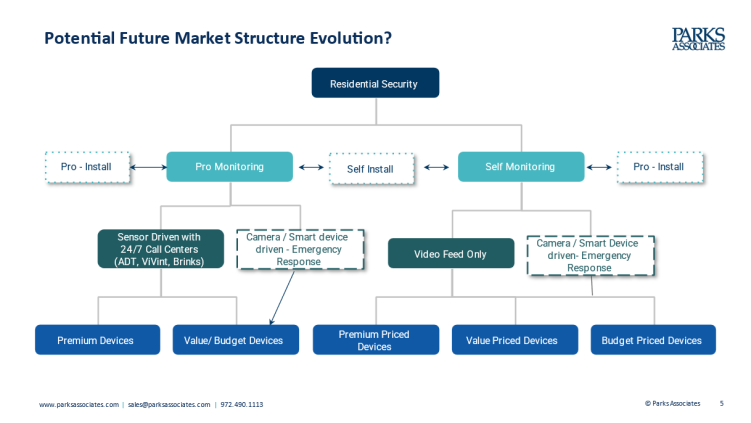

Currently less than a quarter of current home security monitoring subscribers are actively shopping to make a change to their professionally monitored system or service. Historically, consumer choice for residential security systems was largely driven by cost and brand perceptions. Consumers simply chose a provider based on the equipment cost, the monthly monitoring fees, whether it was available in your area, and level of trust for the brand.

As new providers have emerged from adjacent categories and beyond, consumers have many more factors to consider when deciding on what kind of security works for them. Below are just some of the considerations consumers mull over during the security system purchase journey:

- Is an in-person professional assessment of their home required or is filling out an online form enough?

- Is there interest in professional installation or do they want a DIY security system?

- Does their system need cameras as well as sensors or do sensors protect their home enough?

- If the consumer decides cameras are necessary, do they need video storage or just real-time shots?

- Will they need continuous video feeds or event-based recording?

- Is the buyer looking for specific AI technology that enables specific applications?

- How important is professional monitoring?

- Are add-on smart devices like smart doorbells, door locks, water leak detectors, or even cyber security packages of interest?

Some consumers not only do not know exactly what they need or want, but they also may not even understand industry terminology or technology. Clear and simple explanations are important for all interactions, whether they are either in- person, on the phone, or via information online help videos. The quality of explanations can make – or break a sale.

The industry has become highly fragmented and difficult for both consumers and providers to navigate in terms of where to invest their dollars most strategically. For first-time buyers, options are many and it can be difficult to determine the best options. For existing customers, the amount of confusion and time it takes to evaluate a better option than what a consumer already has can quickly cause consumers to fall back into a place of inertia, where staying with what’s familiar is better than taking the risk with a new solution. A company’s ability to break through the confusion and help consumers with meaningful information can be a differentiator in either a positive or negative direction.

At the same time, consumers are becoming more tech-savvy. The level of differentiation between providers is quickly eroding given the commoditization of monitoring services. Over the next five years, six key areas that have the greatest potential impact on determining where market share could land in the future:

- Affordability

- Differentiation of features/depth of offerings

- Positioning and relationship with customer

- Consolidation and partnership

- Disintermediation

- Smart home integration

One key area is differentiation of features in security solutions. Because it is difficult for a consumer to navigate the variety of security solutions available, often, they focus on price as the most tangible and easily comparable differentiators. Most providers offer similar hardware, services, financing options, and warranties/trial periods, video monitoring capabilities, artificial intelligence features and, in some cases - relatively the same market positioning.

To the average consumer, it might seem price is the only differentiator. The entrance of low-cost providers is also forcing those price gaps between premium, value, and budget devices to shrink. Despite the margin pressure associated with lowering their device prices, premium players are differentiating in a number of ways:

- AI and video verification

- Emergency response offerings

- Focus on privacy and security

- Protecting property and the whole home

- Innovate core value proposition

- Brand positioning

Investing in AI and smart technologies is a difficult investment for smaller providers. For some, the AI in the devices is the foundation for their SAAS service to be built upon vs. passing the features onto customers as a new level of premium services. The question is whether these AI advancements will be worth the premium price or whether devices/software have reached a “good enough” plateau for the majority.

Implications about Competitive Strategies

In 2010, Parks Associates predicted that the traditional security industry, as it was known then, would transform itself to a smart home based on security industry. It appears that transformation is on track. The transformation is not complete, however. Furthermore, not all security providers will evolve in the same way.

The marketplace is beginning to witness the development of tiers, even with the movement towards security with smart home. Time and technology will exacerbate these differences. Complex homes and large homes will continue to require more sophisticated and expensive solutions than do small homes and apartments. Single product solutions like a camera may well serve an apartment with a one-door entrance. Areas for regular study and company comparisons are below:

Differentiation

Premium players need not continue to chase low-cost providers down the current price continuum. It is better to identify the segment of the market that will simply tolerate a premium player’s pricing and deliver enough value to merit trust. Seek feature differentiators. Ease of use and the completeness of available solutions have true value to consumers with complex homes and the wherewithal to pay for those solutions. If a base product is on the docket, create another product brand for the market segment that will not or cannot bear a premium player’s pricing and develop that. That said, it is important for these premium players to continue the innovation that delivers value-added features across all segments.

Product Development

All competitors, regardless of their solution level, need to create and/or decide the best offerings for the internet US households that are expected to grow the residential security industry in the next five years. Right off, that means special attention to the demographics, housing conditions, and attitudes of this group so service providers can zero in on optimal bundles.

Messaging

As new market entrants demonstrate that innovation and cost may trump industry awards and experience for new consumer segments, traditional and long-standing players in both the professional monitoring and DIY segments may be forced to explore benefits beyond the peace of mind table stakes all competitors are messaging to the same consumer segments. Ease of use is next to reliability; expandability follows that.

Partnerships

Smart home solutions that can include automation are on track to extend beyond the traditional home. Once unified protocols exist under the Matter initiative, companies will once again be forced to think about why their smart home hub should be the chosen control center for a consumer’s home automation. Ease of use will no doubt be at the center of consideration. However, exclusive interoperability with a wide array of the newest smart home devices could also help sweeten the proposition.

Channel Expansion

Traditional security system providers are exploring new channels for sales and distribution. DIY players to consider the same tactic to avoid falling behind. Insurance companies are already part of the mix of channels due to their discounts. Energy utilities have made a stab at involvement but it most cases it has been weak. Current conditions including the rapid increase of utilities may change that.

Parks Associates has been studying the technology markets for over thirty years. We would love to help you better understand the growth areas and navigate changes in the market. Please contact me or our team if you would like to talk about how we can help you grow your business. Thanks for your great support of our research work.