Wearables are the leading product category in connected health, with smart watches the most adopted product overall. Smart watch owners are a particularly enthusiastic core of the connected health market, as they tend to own a variety of other products, including connected fitness devices, connected weight scales, and even more medically oriented devices such as smart thermometers.

Since 2019, adoption of wearables from Apple and Samsung has grown exponentially, helping to drive the overall smart watch market forward. Apple Watch adoption has tripled among heads of US broadband households, while Samsung wearables adoption has more than quadrupled. Adoption of Samsung wearables is on-track to exceed adoption of Fitbit devices in 2022.

With these devices increasingly serving as the anchor product of consumers’ connected health device ecosystems, the ability for other connected health device products to integrate with the software platforms from these companies is becoming highly important. This echoes what has been occurring in the smart home space with Alexa and Google Assistant integration.

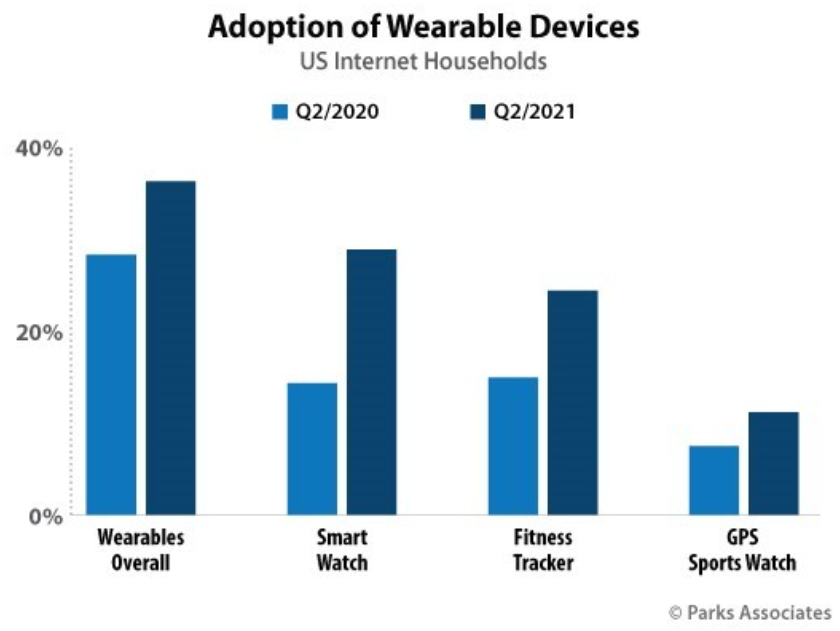

Consumer intention to purchase wearables has more than doubled compared to 2020, with all tested categories seeing dramatic increases. The overall market for wearables is increasing, with many new consumers interested in purchasing. Top wearables use cases remain clustered around activity, health, wellness, exercise, and goal-tracking. While these are common across consumer groups, older consumers and women are particularly likely to use core features such as tracking general activity levels.

Prospective buyers of smart watches are also interested in add –on subscriptions. A majority of smart watch purchase intenders report that they are “very likely” to pay for an additional cellular plan for their new smart watch – equating to nearly 30M US households and a $3.5B+ annual revenue opportunity for mobile providers.

Interest in at-home fitness programs is also high, with nearly half of wearables and connected fitness device owners reporting that they are interested in subscribing to such a program. Note that the at-home fitness subscription was described to respondents as “an online fitness service that offers an on-demand library of workouts that pulls in data from your wearable, displays it on a screen when you exercise, and offers personalized feedback” similar to Apple Fitness+.

There is a strong overlap in cellular smart watch intenders and those who intend to purchase home fitness subscriptions – companies have an opportunity in meeting the demands of both markets. Those that do not may risk losing customers to those who can. The wearable market continues to grow, with continued interest from consumers on subscriptions for ongoing health monitoring.