The connected home market is ripe with opportunity. Consumers now have an average of 15 connected devices in their homes, and 37% of US broadband households own at least one smart home device. Smart home, connected health, and connected entertainment products provide an increased level of convenience for consumers through home automation and home security applications, energy management and energy efficiency services, new video distribution options through various connected devices, and the ability to control and monitor the home remotely.

Connectivity is becoming a standard feature for products in consumers’ homes and Parks Associates estimates over 111 million US households have broadband internet access at year-end 2021.

In many cases, the first few generations of connected products have provided a basic level of convenience and with relatively low price. Manufacturers and service providers now need to find new ways to leverage that connectivity that adds real value to consumers’ lives.

Generating incremental revenues through value-added services that leverage core assets in new ways is becoming key to future success for many companies. By layering new services, adding features, and expanding use cases, companies are able to create new value for consumers at home, and find new ways to create new revenue streams.

BROADBAND AND MOBILE SERVICES: BUILDING BEYOND CORE SERVICES

MSOs enhance the value of their relationships with existing customers by offering endpoint security suites, often for free to high-value customers and for a modest monthly fee to lower tiers of users. Bundled features may also include password management, AV removal tools, and parental controls. Some providers, like Comcast, offer identity theft and VPN products as well. Behind the scenes, some carriers are testing and/or integrating the most advanced network security services offered by Cujo Ai, Dojo by Bullguard, and F-Secure, though they are not yet being marketed as premium upgrades.

Mobile providers have also entered the parental controls market. According to Disney Circle, the 2018 parental control market is roughly $2.2 billion globally, with roughly $600 million of that coming from North America. Through controls, parents can filter content, put a time limit on screens, and schedule a bedtime for every family member through new applications, and also monitor viewing habits and have remote control for content to be accessed.

SMART HOME DEVICE MANUFACTURERS ARE ATTACHING SERVICES

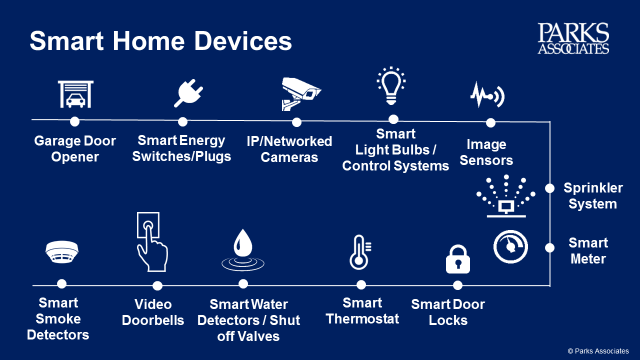

Smart home access control devices, including primary devices smart door locks, smart garage door openers, video doorbells, and IP cameras maintain a detailed record of who has entered the home, which doors were accessed and when, and even how long individuals stayed. Increasing device adoption enables new home services like in-home and in-garage package delivery and access control for home cleaning, pet care, and home health services.

Secure package delivery is a use case that hits home with consumers. Parks Associates data finds that nearly 40% of smart access control device owners or intenders would pay up to $1.98 per package for delivery inside their home or garage. Companies in a prime position to capitalize on this opportunity include e-commerce giant Amazon, but also smart access control product manufacturers. Expanding the value proposition of devices like smart garage door openers can greatly expedite growth in the market, as traditional garage door openers typically have a lifecycle of 10 or more years.

HOME SECURITY PROVIDERS EXPAND BEYOND ACCESS CONTROL

Extending security services and interactive platforms to support connected health and wellness applications and services is another path to new revenues for security ecosystem players. Remote health monitoring for consumers with chronic conditions and care for elderly family members are particularly attractive use cases that leverage some of the assets and expertise of residential security and smart home players.

Alarm.com has developed an independent living platform adapted for consumer residences, builders, property managers, and the commercial healthcare market. The platform applies machine learning and predictive analytics to data gathered by smart home sensors, security systems, connected medical devices, health and fitness wearables, personal emergency response (PERS) systems, and smart speakers. The machine learning application translates the data into behavioral activities to create a profile of normal behavior for each customer. As the system compares daily activities to the stored model, it can identify anomalies and issue alerts for trends that are not normal or healthy.

These exception-based alerts may involve unexpected activities (entries and exits, bathroom visits, kitchen visits) or wellness notifications (prolonged inactivity, higher or lower than expected activity). Customers have the option to create new customized notifications to immediately inform them of potential issues unique to the needs of their loved one, providing a personalized safety net to the senior.

Understanding consumer purchase intentions can guide these future product and service offerings. As connected home players attempt to drive market growth, an understanding of what drives these intentions and the motivation behind follow-on purchases will be a critical part of the equation. While purchase intentions continue to grow, consumers overall still do not understand the value of some of the benefits of connected products, especially smart home devices. Two ways to combat this perception include:

Drive product improvement using data analytics and artificial intelligence

Artificial intelligence and big data applications can continually add more value to smart home and IoT solutions at the application level, often without requiring substantive hardware changes. Companies are enhancing traditional single-sensor devices with additional sensors for motion, temperature, video, audio (near- and far-field), humidity, light, and more. Additional sensors provide more context for device control, ultimately feeding artificial intelligence applications with data that can provide more predictive and personalized automation. For example, when multi-sensor devices are integrated into and managed by smart home or security services, they create value that can be captured by whole home energy management services, connected health monitoring services, or insurance risk mitigation services.

Sell solutions versus products – Given that consumer familiarity with many smart home products is low, it may be difficult for consumers to truly understand a product’s value and how it can impact their lives. Therefore, it is important to communicate product features in ways that demonstrate how they address or provide solutions to current consumer challenges. Telling the story of what products can do is very important to capturing the consumer’s attention.